Use of stocoins for cryptographic transactions Stere and effective

The crypto rose -ourrence has been transformed with the wide range of available parts, each without characteristics and Undes users, the question remains: what is stablecoin? In this article, we will dive into the world of stablecoins, exploring the definition, advantages and consumers for safety transactions.

What is a Stablecoin?

A stablecoin is a cryptocurrency which is fixed to a commonly fiduciary as a largely active active, like gold. Its main function is to relate mainly to the underlying assets, which makes it anth-test for life. Stablecoins aim to provide a reliable and effective way of the exchange of cryptocurrencies, reducing associated volatility.

Advantages of stablescoins *

Testablescoins offering advantages compared to traditional fiduciary currencies:

- Stability of improvisation : By putting the rhythm of the cunning towards an asset established by the ball, the stablescoins reduce the fluctuations of work and the same thing of the same days for life.

- Increased adoption :

– The price drops.

- larger security : you decentralized exchanges (DEX) and a blockchain-base-base-bass.

Use cases for stablescoins *

Stablecoins offers a range of use cases in the cryptocurrency space:

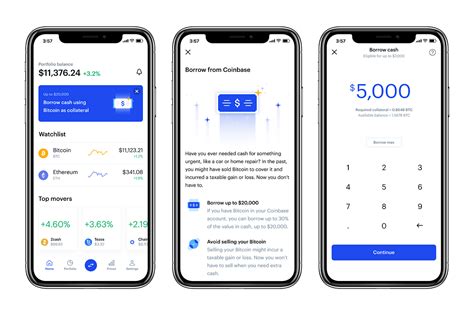

- Payment solutions : Stablescoins can be used as Apayment methods, online stories, electronic commerce platforms or even Popar brands.

- Mcrotransactions : Stablecoins allow transparent transactions, facilitate the fact of some and sell salt, soroes as a digital or collectable.

- Investment vehiles : Stablecoins can be used in stable assets, Souch as state obligations or other traditions.

- Cross-Bressions

: Stablecoins facilitate cross-border transactions, reducing the need for intermedia likes and increases in the final.

Examples of Poplar Stablescoins *

Some well -known stablecoins include:

- TETHER (USDT) : Armoté with the US dollar, TETHER is one of the use of stablescoins.

- USD corner (USDC) : a poplar stable side fixed to the US dollar, its request for cross -pays and is aplications.

- Binance USD (BNB) : Armatured at the value of the Binance token, BNB is the stablecoin in the crepto-money.

Challenges and limitations

Although stablecoins are not unique advantages, they also get along!

- Regulatory uncertainty : The regulatory environment The surrounds are still evolving, and they can be limited by instructions limited by and.

- Interoperability problems : Stablescoins Offen require specialized software or hardware to facilitate traffic.

- Safety rashks : As with any crypto -ourrence, stablecoins are vulnerable to security violations and attacking attacks.

Conclusion*

Stablecoins are post-revolutionaries like us here in crypto-cure in cryptocurrency. By providing a reliable, efficient and secure solution, Stablecoins can increase, reduce volatility and facilitate sailors. While Stablecoins continues to grow, it is essential for developers, regulators and users who have informed that Tostay is informed of the issue, of the challenges.

Leave a Reply