Indeed, with the proof displaying that the majority day traders lose money over time, it’s an especially risky profession choice. Day traders, both institutional and particular person, would argue that they play an important role in the marketplace by keeping the markets efficient and liquid. The quantity of capital required for day trading varies primarily based on individual methods and threat tolerance. Most brokerages require a minimal of $25,000 to day trade to find a way to keep away from the “sample day trader” rule. Make certain to verify with your dealer to see what their specific requirements are for day merchants.

Regardless of what approach a day trader makes use of, they’re often looking to trade a stock that strikes (a lot). The revenue potential of day trading is an oft-debated subject on Wall Street. Internet day-trading scams have lured amateurs by promising monumental returns in a brief period of time. There was a time years in the past when the one individuals able to commerce actively in the inventory market were these working for large financial establishments, brokerages, and trading houses. The arrival of online buying and selling, along with instantaneous dissemination of reports, has leveled the playing—or should we say trading—field. For astute traders in search of to discover new avenues within the financial markets, day buying and selling presents an intriguing alternative.

Risks Of Day Trading

The extra a financial instrument strikes, the extra opportunity there could be for day traders. Stock screeners are available that can determine shares above set value ranges (which will weed out illiquid penny stocks) and stocks that often have high volatility. Assess and decide to the quantity of capital you are willing to danger on every trade. Many profitable day traders threat less than 1% to 2% of their accounts per commerce. If you have a $40,000 trading account and are prepared to threat zero.5% of your capital on every commerce, your maximum loss per trade is $200 (0.5% x $40,000). Moreover, only trade with appropriate online brokers and trading platforms.

This consists of information aggregators, social media, and financial information websites. Understanding how different varieties of news (economic, political, corporate) affect market sentiment is important for making informed trading choices. Success in scalping and momentum buying and selling requires self-discipline, patience, and steady studying.

Regulatory our bodies usually have particular requirements; for instance, in the stock market, the Pattern Day Trader rule in the U.S. requires a minimal of $25,000 in your trading account. However, it’s potential to begin with less capital by buying and selling merchandise like forex or futures. It’s important to guarantee that your trading capital is not borrowed or crucial in your every day expenses. Scalping includes making numerous trades throughout the day, aiming for small income from every trade. It requires fast decision-making and a good understanding of market movements. Scalping is appropriate for merchants who can dedicate time and attention to the markets and deal with the high-pressure environment of speedy buying and selling.

What Is The Distinction Between Day Trading Vs Swing Trading?

A thorough understanding of forex and commodity markets is crucial for successful buying and selling in these areas. Having a predefined strategy for every trade minimizes emotional decision-making. Achieving consistency in trading is about disciplined shopping for and selling, aligned along with your general buying and selling technique.

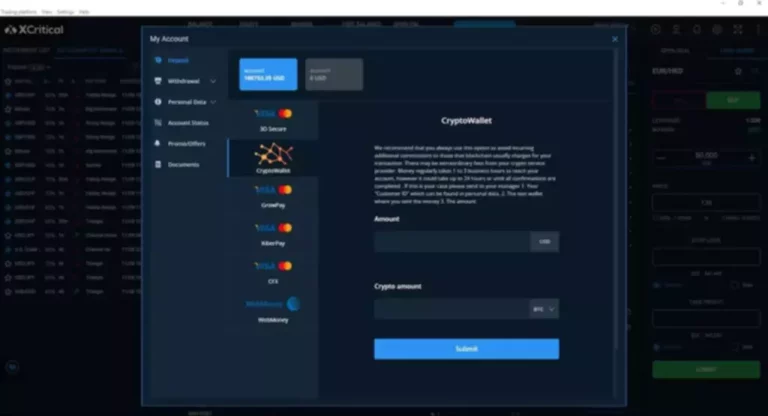

Commission-free on-line broker accounts have made day trading a lot easier and value efficient. Not solely was this very time-consuming, however it also value you rather more per commerce. In addition, newbie buyers did not have easy accessibility to market information. Such information consists of important economic day trading platform and earnings stories, as nicely as dealer upgrades and downgrades that occur either earlier than the market opens or after the market closes. If your technique works, proceed to trading in a demo account in actual time. If you take income over the course of two months or extra in a simulated surroundings, proceed with day buying and selling with actual capital.

What Does A Day Trader Do? Are Day Traders In India Successful?

For instance, determine whether a candlestick chart pattern indicators price moves within the path you anticipate. Most scalpers will close positions earlier than the end of the day, because the smaller profit margins from each trade will shortly get eroded by in a single day funding expenses. Day trading indices would fall into an identical pattern as share buying and selling, due to the restrictions of market opening hours. Day buying and selling indices would due to this fact provide you with exposure to a larger portion of the inventory market. Individual traders usually manage other people’s cash or simply commerce with their very own.

Like gamblers, day merchants ought to only threat money they will afford to lose. While a choose few are able to generate steady profits, these are generally people who had careers within the monetary trade or who have devoted themselves to learning markets. Day buying and selling also entails quite lots of research, not only into the charges and commissions on their trades but in addition the related taxes and rules.

Day Trading Vs Different Forms Of Trading

Spread bets and CFDs are complex devices and come with a excessive danger of dropping cash rapidly due to leverage. 71% of retail investor accounts lose money when trading unfold bets and CFDs with this supplier. You ought to consider whether or not you understand how unfold bets and CFDs work, and whether you’ll have the ability to afford to take the high risk of losing your money. People with out prior experience should start with understanding market fundamentals. It’s advisable to seek steering from skilled traders or firms specializing in buying and selling training.

The draw back of this account sort is that a trader has to wait for the money to “settle” to make use of it once more … This can restrict the number of possible trades. If a trader has less than the $25,000 minimal fairness stability of their account, they’re limited to 3 day trades within a rolling five-day period. Once you set up and fund your account, you’re able to lookup stocks.

Day buying and selling differs considerably from traditional investing in phrases of technique, threat, and time horizon. Different account types and margin choices can significantly impression your buying and selling fashion. Evaluate the broker’s offerings to make sure they meet your trading needs. Trade execution pace is critical in day buying and selling, where milliseconds can make a distinction. Start by studying basic trading strategies and progressively advance to more complicated ones. Understand the mechanics and dangers of various strategies to find what works best for you.

Setting stop-loss orders, managing position sizes, and having a clear exit strategy are important components of managing dangers in these high-paced buying and selling methods. Currency and exchange rates are crucial in international buying and selling. Fluctuations in change rates can considerably influence your income and losses, particularly when buying and selling Forex or worldwide commodities. Monitoring forex developments and understanding the factors that affect exchange rates is a vital talent for any day dealer. Traders purchase securities in an uptrend and promote brief in a downtrend, capitalizing on the market’s momentum. It requires an understanding of technical evaluation and market indicators to identify tendencies precisely.

Why Day Buying And Selling Is Controversial

This step ensures that someone new to buying and selling builds a stable foundation earlier than actively participating out there. It’s important to know the buying power and never overextend your position, preserving in thoughts the potential for pattern reversals. In both instances, maintaining a stability between maximizing positive aspects and defending your earnings is vital to long-term success.

Most US brokers have lowered the obstacles to entry to the extent that there is not any minimal deposit to open a trading account. Commission-free stock trading is the norm and fractional share buying and selling has made it potential to commerce high-priced shares even in case you have a tiny account balance. Stocks and other investments are all the time subject to general value developments. If a stock loses cash one day, it’d keep shedding money as other investors money out.

Leave a Reply