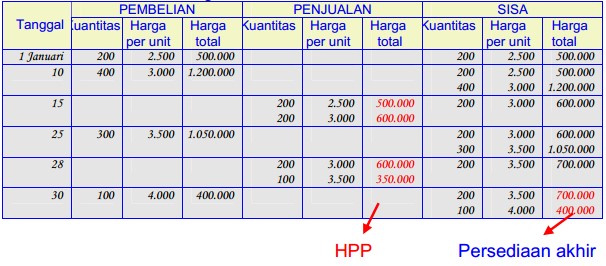

As we discussed above, FIFO results in a higher gross profit during periods of rising prices. However, if a company used LIFO during a period of rising prices, gross profit would be lower. The key takeaway here is that when you’re calculating the cost of goods sold or ending inventory using periodic FIFO, the date on which the company sold the goods doesn’t matter. You simply assume that the oldest stock is sold first and apply this assumption to your calculations.

Types of Companies in Managerial Accounting

On 3 January, Bill purchased 30 toasters, which cost him $4 per unit and sold 3 more units. In accounting, First In, First Out (FIFO) is the assumption that a business issues its inventory to its customers in the order in which it has been acquired. Figure 10.20 shows the gross margin, resulting from theweighted-average perpetual cost allocations of $7,253.

Perpetual FIFO vs. Periodic FIFO

See the example LIFO perpetual inventory card below to get an idea of how it works. The retail sales for this product in this company were $25,000 from Jan. 1, 2019 to Jan. 15, 2019. The last-in, first-out method (LIFO) of cost allocation assumesthat the last units purchased are the first units sold. At the time of the second sale of 180 units, the LIFOassumption directs the company to cost out the 180 units from thelatest purchased units, which had cost $27 for a total cost on thesecond sale of $4,860. Thus, after two sales, there remained 30units of beginning inventory that had cost the company $21 each,plus 45 units of the goods purchased for $27 each. The lasttransaction was an additional purchase of 210 units for $33 perunit.

- Second, every time a sale occurs, we need to assign the cost of units sold in the middle column.

- The last-in, first-out method (LIFO) of cost allocation assumesthat the last units purchased are the first units sold.

- Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners.

- The three cost flow assumptions that businesses use for this are FIFO, LIFO, and the Weighted Average Cost (WAC).

- The company then applies first-in, first-out (FIFO) method to compute the cost of ending inventory.

FIFO vs. LIFO

When calculating any inventory method under periodic, it is best to separate the purchases from the sales. The goal of using the WAC is to give every inventory item a standard average price when you make a sale or purchase. In a perpetual system, you would not calculate the WAC using a formula for a specific period. You can use WAC to calculate an average unit cost, COGS for a period and ending inventory for a period.

Periodic Inventory System:

The company then makes a count of the physical inventory and the accountant shifts any balance in the purchases into the inventory account. Next, the accountant adjusts the inventory account to match the cost of the ending inventory. This number is critical since the company does not track unique transactions. Whether the company performs it weekly, monthly, quarterly or annually, this inventory kicks off the records reconciliation. This results in deflated net income costs in inflationary economies and lower ending balances in inventory compared to FIFO. The inventory item sold is assessed a higher cost of goods sold under LIFO during periods of increasing prices.

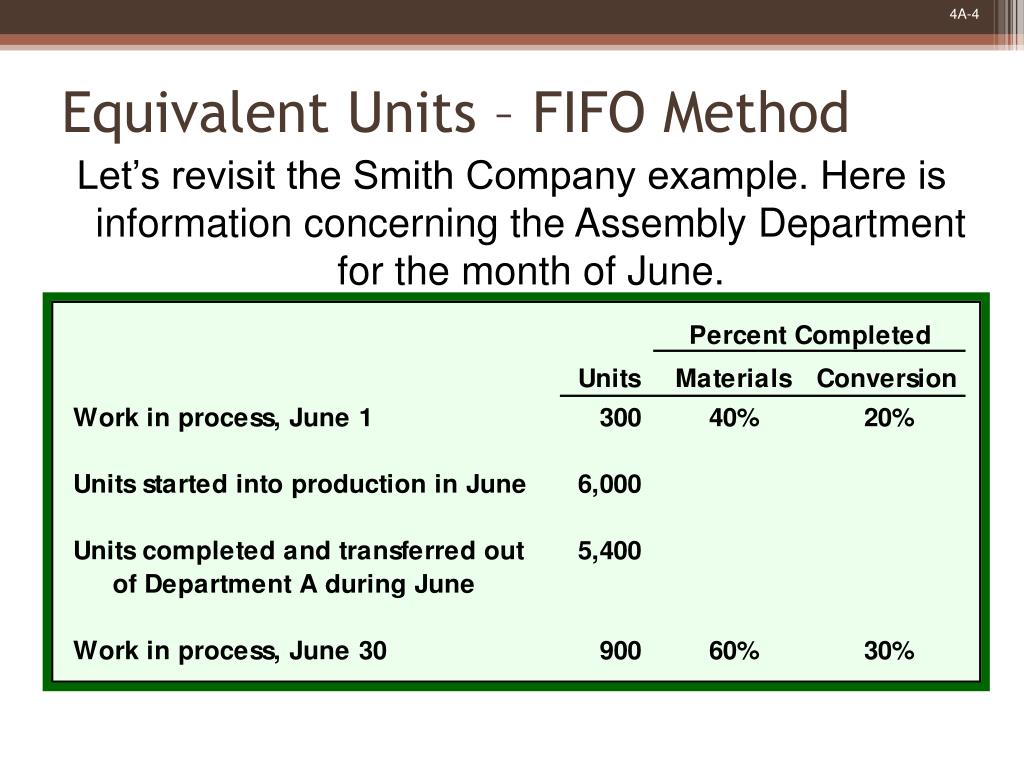

Employees feed this information into a continually adjusted database that tracks each change. The automatic, or perpetual, updating of the inventory is what gives the system its name and differentiates it from the periodic approach. Remember that under FIFO, periodic and perpetual inventory systems will always give you the same cost of goods sold and ending inventory. When calculating using the perpetual systems, do not separate purchases and sales. At the time of each sale, we must consider what units are actually available to be sold. The company has the units from beginning inventory and the purchase on January 3rd.

The cost ofgoods sold, inventory, and gross margin shown in Figure 10.13 were determined from the previously-stated data,particular to specific identification costing. Grocery stores want to sell their oldest inventory first, so it doesn’t spoil or expire. The grocery store’s approach reflects the FIFO inventory method, which assumes that the why you should hire an accountant for your personal finances store sells its oldest inventory items first. That means that you’ll use the oldest costs to calculate the cost of goods sold. Large businesses with enormous quantities of inventory favor perpetual inventory systems. Perpetual inventory systems can also be ideal for emerging and small to medium-sized businesses looking for scalability.

If you want to read about its use in a perpetual inventory system, read “first-in, first-out (FIFO) method in perpetual inventory system” article. During periods of inflation, a LIFO system may be more appropriate for companies that do not wish to pay as much in taxes, because it will show a higher COGS expense and a lower net income. Therefore, your company has a lower tax liability in a LIFO system, because businesses get taxed on profit.

Second, every time a sale occurs, we need to assign the cost of units sold in the middle column. When a business buys identical inventory units for varying costs over a period of time, it needs to have a consistent basis for valuing the ending inventory and the cost of goods sold. When using the perpetual inventory system, the Inventory account is constantly (or perpetually) changing. With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account. Since this is the perpetual system we cannot wait until the end of the year to determine the last cost (as is done with periodic LIFO).

Marketers can set current information in the context of historical trends to understand customer behavior and position the company to meet anticipated customer demand. Perpetual inventory methods are increasingly being used in warehouses and the retail industry. With perpetual inventory, overstatements, also called phantom inventory, and missing inventory understatements can be kept to a minimum. Perpetual inventory is also a requirement for companies that use a material requirement planning (MRP) system for production. So, after the sale on January 15, the business records COGS of $98 and has $42 worth of inventory remaining, according to the perpetual FIFO method.

Leave a Reply